Overview: Federal $2,000 Payments Arriving January 2026

Beginning in January 2026, many eligible individuals will receive a federal $2,000 payment. This guide explains who is likely to qualify, how payments will be distributed, and practical steps beneficiaries should take now.

Who Qualifies for the Federal $2,000 Payments

Eligibility rules are set by federal law and may target specific groups such as Social Security recipients, veterans, low-income households, or taxpayers meeting income thresholds. Check official announcements or your benefits statements for your exact status.

Common eligibility categories include:

- Social Security retirement and disability beneficiaries

- Supplemental Security Income (SSI) recipients

- Veterans receiving VA benefits

- Tax filers who meet adjusted gross income limits

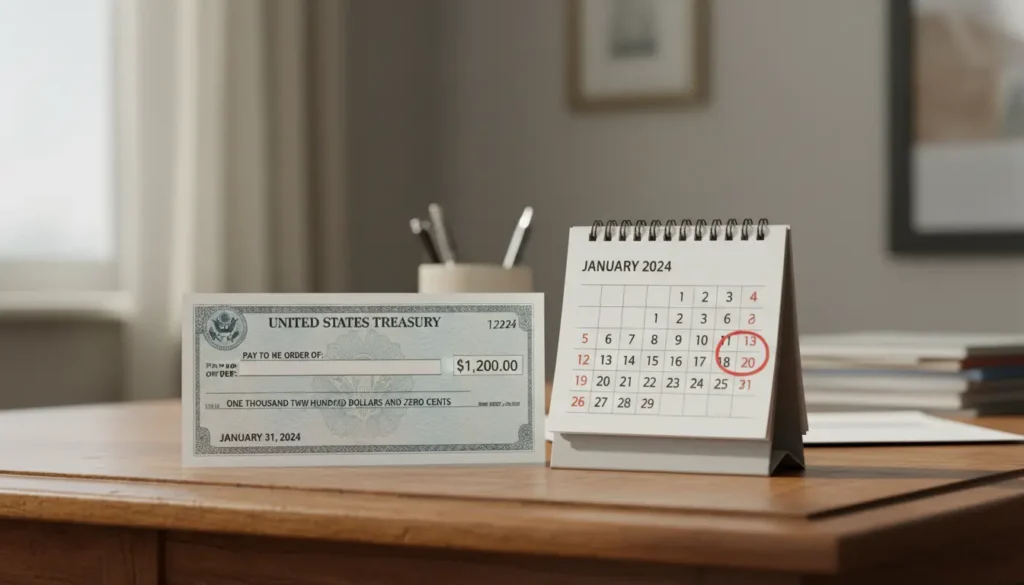

How Federal $2,000 Payments Arriving January 2026 Will Be Sent

Payments will be sent using methods based on the federal agency that manages your benefit or your tax filing information. The most common delivery methods are direct deposit, paper check, or prepaid debit card.

Direct Deposit

Direct deposit is fastest and most secure. If you already receive benefits by direct deposit, the $2,000 payment will likely use that same account. Expect the deposit date to appear on your account statement.

Paper Checks and Prepaid Debit Cards

If you do not have direct deposit on file, the government may mail a paper check or a reloadable prepaid debit card to your address of record. Allow extra time for mail delivery.

What Beneficiaries Should Do Now

Take simple steps in advance to reduce delays and avoid fraud. Verify your contact information, bank details, and benefit status with the agency that pays you.

- Confirm your mailing address and direct deposit information with Social Security, the IRS, or the VA.

- Monitor official agency websites for payment schedules and FAQs.

- Be aware of scams: the government will not ask for payment to receive your $2,000.

Key Dates and Timelines

January 2026 is the target month for initial distribution. Different agencies may stagger payments over several weeks. Keep an eye on official emails, letters, or online accounts for the exact date tied to your case.

If you do not receive the payment in January, wait a few weeks before contacting your benefits office; mail and processing delays are common during mass distributions.

Many beneficiaries who update their direct deposit information online avoid mailing delays and receive payments several days earlier than paper checks.

How to Check Payment Status

Each paying agency may offer an online portal or phone line to check payment status. Use secure portals like your Social Security account, IRS Get My Payment tool (if available), or your VA eBenefits account for updates.

When checking status, have your Social Security number or taxpayer ID and your date of birth ready to verify identity.

What to Do If You Did Not Receive the Payment

If your payment does not arrive by the end of January or early February, follow these steps to resolve the issue:

- Confirm eligibility and that no follow-up action was required on your part.

- Check that your direct deposit or mailing address is current with the issuing agency.

- Contact the agency using the official phone number or secure online portal. Avoid clicking links in unsolicited emails or texts.

Common Reasons Payments Are Delayed

- Outdated bank account or mailing address

- Verification or eligibility review required by the agency

- Mail delivery slowdowns or check production delays

Case Study: How a Retiree Claimed the Payment

Maria, a 68-year-old retiree on Social Security, received the $2,000 payment by direct deposit on January 14, 2026. She had updated her bank information online six months earlier after opening a new account.

Because Maria checked her Social Security online account and confirmed direct deposit ahead of time, the deposit posted quickly without extra paperwork. When a neighbor received a mailed check later in the month, Maria reported her friend used a different delivery method and experienced a week-long mail delay.

Protect Yourself Against Scams

Scammers may impersonate government agencies asking for personal data or payment to release funds. Remember these rules:

- The government does not call demanding payment to send your $2,000.

- Do not provide Social Security numbers or bank PINs to anyone who contacts you unexpectedly.

- Use official agency websites and phone numbers to verify any request.

Frequently Asked Questions About Federal $2,000 Payments

Will this payment affect my benefits?

Most one-time federal payments are not considered ongoing income for benefit eligibility, but rules vary by program. Check with your benefits office to see if the payment affects means-tested benefits.

Do I need to report this payment on my taxes?

Tax treatment depends on how the payment is classified. Keep official notices and check IRS guidance for whether the $2,000 is taxable or requires reporting.

Final Checklist for Beneficiaries

- Verify address and direct deposit with your paying agency.

- Monitor official channels in January 2026 for payment dates.

- Save any mailed notices or IRS correspondence for records.

- Report missing payments only through official agency contacts.

Following these steps will help ensure you receive your federal $2,000 payment with minimal delay. Keep documentation, stay alert for scams, and use official accounts to track payment status.