Overview of Federal $2,000 Holiday Deposits Coming January 2026

The federal government will issue $2,000 holiday deposits in January 2026 to eligible individuals. This guide explains eligibility, payment rules, and key deadlines in clear, practical steps.

Who qualifies for the Federal $2,000 Holiday Deposits?

Eligibility is based on citizenship or resident status, income limits, and recent tax filing or benefit records. You must be a U.S. citizen, U.S. national, or qualifying resident alien.

Dependents and mixed-household cases have specific rules. Read the next section for details.

Eligibility rules: income, filing, and dependents

To qualify you generally must meet these conditions:

- Have adjusted gross income (AGI) below the published threshold for your filing status.

- File a 2024 or 2025 tax return (if required) or register with the IRS non-filer tool if you do not normally file.

- Be claimed properly as an individual or a dependent under IRS rules; dependents may change who receives funds.

Special rules apply for seniors, people receiving Social Security benefits, and those on disability programs like SSI or SSDI.

Payment rules for Federal $2,000 Holiday Deposits

Payments will be issued by direct deposit where the IRS or Treasury has banking information. Paper checks and prepaid cards will be used when banking details are not available.

Payments are generally non-taxable income, but reporting rules can vary. Keep documentation of any deposit and check the official IRS guidance for tax treatment.

How the deposit method is chosen

Priority for deposit method:

- Direct deposit to bank accounts on file with the IRS or Social Security Administration.

- Direct deposit to accounts used for past federal benefits.

- Paper check mailed to last known address if no electronic option is available.

- Prepaid debit card mailed in limited circumstances.

If you moved or changed banks since your last tax filing, update your information as soon as possible to avoid delays.

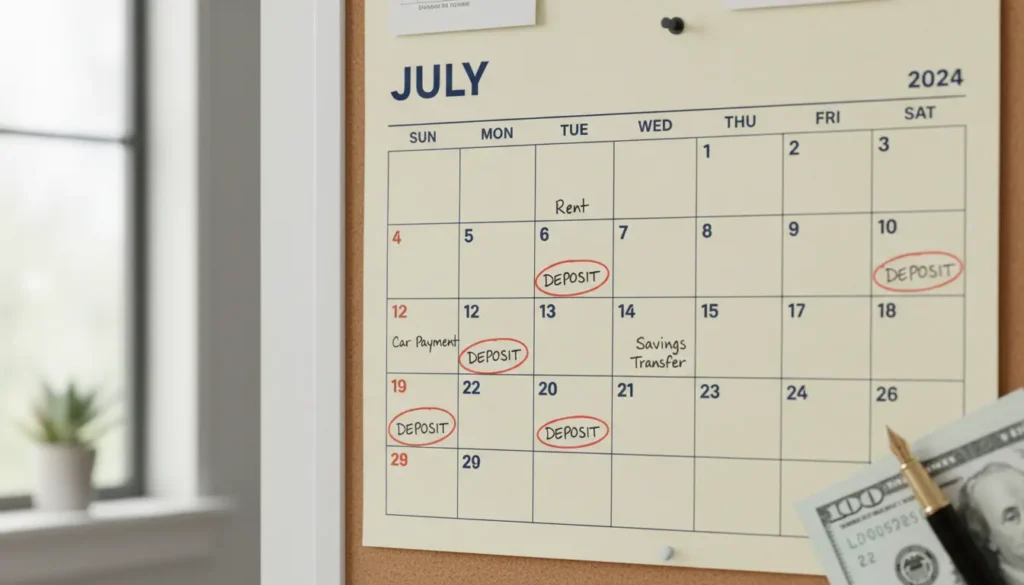

Deadlines and important dates

January 2026 is the primary distribution month. There are separate deadlines for registration and corrections that you must meet to receive a timely payment.

- Early January 2026: Initial batch of direct deposits begins.

- Mid-January 2026: Additional deposits and mailed checks start.

- Deadline to register or correct banking info: Typically one to two weeks before the first deposits; check official IRS notices for the exact date.

- Deadline to file a claim for a missed payment: Varies by program rules; act quickly if you believe you were eligible but did not receive a deposit.

What happens if you miss a deadline?

If you miss the registration or correction window you may still receive a payment later, but expect delays. Missing the official claim deadline could require filing a sequence of forms to request recovery.

Keep copies of tax returns, benefit statements, and correspondence to support a claim.

How to check status and correct errors

Use official IRS and Treasury web pages to check payment status. The IRS will likely update its “Get My Payment” or similar portal with the January 2026 deposits.

If your deposit amount is wrong or missing, follow these steps:

- Check online status using the IRS payment portal or your benefit account.

- Confirm your banking and mailing address are current in IRS records.

- Contact the IRS or Treasury help lines and be ready with your SSN, filing status, and recent tax return details.

Common causes of missing payments

- Wrong or outdated bank account information.

- Unfiled required tax return for 2024 or 2025.

- Being claimed as a dependent on someone else’s return.

- Income above the eligibility threshold.

Individuals who receive Social Security retirement or disability benefits and do not normally file taxes often receive stimulus-type deposits automatically because benefit agencies share data with the IRS.

Tax and recovery rules for Federal $2,000 Holiday Deposits

Most federal one-time deposits of this nature are not counted as taxable income, but law can vary. Save all notices you receive with the payment.

If you received an overpayment due to eligibility changes, the government may issue a notice and request repayment. Do not ignore such letters; follow the appeal or repayment instructions promptly.

Practical steps to prepare now

Take these actions this month to reduce delays:

- File any overdue 2024 tax returns if required.

- Register as a non-filer with the IRS tool if you don’t usually file taxes.

- Update bank and mailing information with the IRS and Social Security if it has changed.

- Watch the official IRS announcements and verify portal deadlines.

Real-world example

Case study: Maria is a single parent on SSDI. She confirmed her bank info with the SSA in November 2025 and filed a simple 2024 return to report part-year work. Her direct deposit showed in her account on January 12, 2026. When a neighbor with the same name did not receive a payment, the neighbor discovered she had been claimed as a dependent on an old tax return and resolved the issue by filing an amended return and contacting the IRS.

Where to get official help

Rely on the IRS and U.S. Treasury for rules and timelines. Avoid third-party services that charge fees to register for a government payment.

Contact information and official portals will be listed on IRS.gov and Treasury.gov. Keep identifying documents handy when you call.

Following these steps will help you determine eligibility, avoid common mistakes, and meet payment deadlines for the Federal $2,000 Holiday Deposits coming in January 2026.