An IRS direct deposit update is prompting many people to act quickly. If you are expecting a $2,000 payment beginning January 18, this guide explains the rules, who qualifies, and exactly what to do now to avoid delays or scams.

What the 2000 IRS Direct Deposit Update Means

The update notifies eligible taxpayers that the IRS will begin sending direct deposit payments starting January 18. Payments will be sent to bank accounts on file with the IRS or the Social Security Administration when applicable.

This is an administrative payment schedule; it does not change eligibility rules. The update often includes timing windows, verification steps, and recommended actions to ensure deposits land in the correct account.

Who is likely to qualify

Eligibility usually follows existing legislation or IRS guidance tied to tax filing status, income thresholds, or specific programs. Typical qualifiers include:

- Taxpayers who meet the program income and filing requirements.

- Recipients who filed a recent tax return and provided bank direct deposit information.

- Social Security beneficiaries if the administering program uses SSA records for deposit routing.

Payment timing and routing

Payments starting January 18 will be routed to the bank account the IRS or SSA has on file. If you changed banks since your last tax return, payments may go to your old account.

The IRS generally posts a payment release schedule but timing can vary by bank processing times. Expect deposits to appear on or after the posted date.

Key Rules in the Direct Deposit Update

Understanding the rules reduces the risk of lost or misrouted funds. The main points to know are:

- The IRS uses the most recent direct deposit information it has. Updating the IRS after the cutoff may be too late.

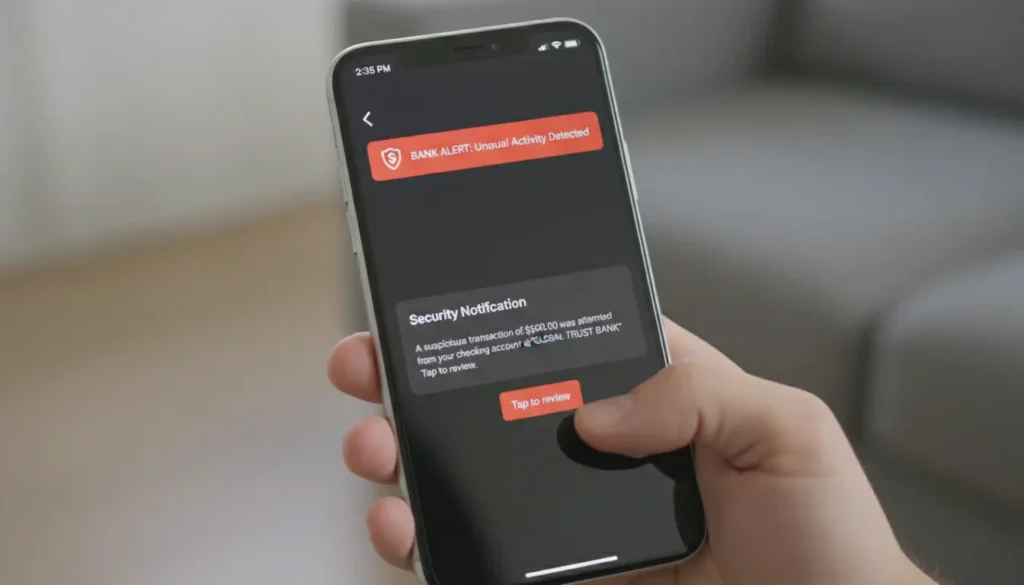

- Only authorized IRS tools and official notices will request your bank details. Scammers often mimic IRS messages.

- If a deposit is returned, the IRS will usually mail a paper check to your last known address.

Official communication channels

Check information only on IRS.gov, the IRS2Go app, or letters mailed by the IRS. Do not provide bank account details in response to unsolicited emails, texts, or social media messages.

What To Do Immediately

If you expect a $2,000 direct deposit starting January 18, follow these immediate steps to protect your payment and personal data.

Steps to take now

- Verify your bank account: Log in to your bank and confirm accounts are active and able to receive ACH deposits.

- Check IRS account info: Visit IRS.gov and use secure account tools to confirm your most recent direct deposit data and mailing address.

- Update address if needed: If the IRS has your old address, update it using official forms or through your tax preparer when you file.

- Set bank alerts: Enable deposit notifications in your banking app so you see the deposit immediately when it posts.

What if you changed banks recently

If you switched accounts after your last tax filing, your payment may go to the old account. Contact your old bank immediately and ask about returned ACH deposits or forwarding options.

If the deposit is returned, the IRS will generally issue a check to your address, but this process can take additional weeks.

The IRS will typically reissue a payment as a paper check if a direct deposit is returned. That mailed check can take extra time to arrive, so timely account verification helps avoid delays.

How to Check Payment Status

Use only official IRS tools to check payment status. The IRS sometimes offers online portals or secure messaging for authorized users.

- Visit IRS.gov for the latest status tools and updates.

- Use the IRS2Go mobile app to receive alerts and account information.

- Keep an eye on your bank account and save any IRS notices you receive by mail.

If you don’t see the deposit

First, wait two business days after the announced date for bank processing. If the deposit still does not appear, gather documentation: recent tax return, bank statements, and any IRS notices.

Then contact the IRS using phone numbers on IRS.gov or consult a tax professional for next steps. Be prepared for hold times and verify phone numbers directly from the official site.

Case Study: Real-World Example

Maria, a freelance graphic designer, expected the payment on January 18. She had switched banks in December and assumed the IRS had her new information. On January 19 she did not see the deposit, so she logged into her bank and found no activity.

Maria then checked her IRS account and discovered the IRS still had her old bank routing number. She quickly contacted her old bank, which confirmed the deposit had been returned and provided a return date. The IRS reissued the payment as a check, which arrived three weeks later.

Maria’s actions — checking accounts, verifying IRS records, and contacting the old bank — are the practical steps that resolved her situation.

Checklist: Immediate Action Items

- Confirm bank account is active and can receive ACH deposits.

- Check your IRS account and mailing address at IRS.gov.

- Enable bank alerts for deposits.

- Beware scams: do not click links from emails or texts claiming to be from the IRS unless you verified the sender.

- If missing, collect records and contact the IRS or a tax professional promptly.

Following these steps increases the chance your $2,000 deposit arrives without delay. Act now to verify accounts and watch for official IRS updates as January 18 approaches.