The IRS announced a $2000 deposit scheduled for January 2026. This guide explains who is eligible, when payments arrive, how payments are issued, and steps to take if you do not receive the money.

Who qualifies for the $2000 IRS deposit January 2026?

Eligibility depends on filing status, adjusted gross income (AGI), and whether you are a dependent. The IRS will use 2024 or 2025 tax return data to verify eligibility.

General rules include:

- U.S. citizens and resident aliens with valid Social Security numbers are primary candidates.

- Dependents without qualifying SSNs do not typically receive a separate payment.

- Nonresident aliens and some estates are not eligible.

Income limits for the $2000 IRS deposit January 2026

The payment phases out based on AGI. Exact cutoffs are announced by the IRS, but expect typical ranges like:

- Single filers: full payment up to a base AGI, then gradual phaseout.

- Married filing jointly: higher combined AGI threshold for full payment.

- Head of household: intermediate threshold.

Check the IRS official page for the precise AGI thresholds for January 2026, because phaseout brackets can vary by program.

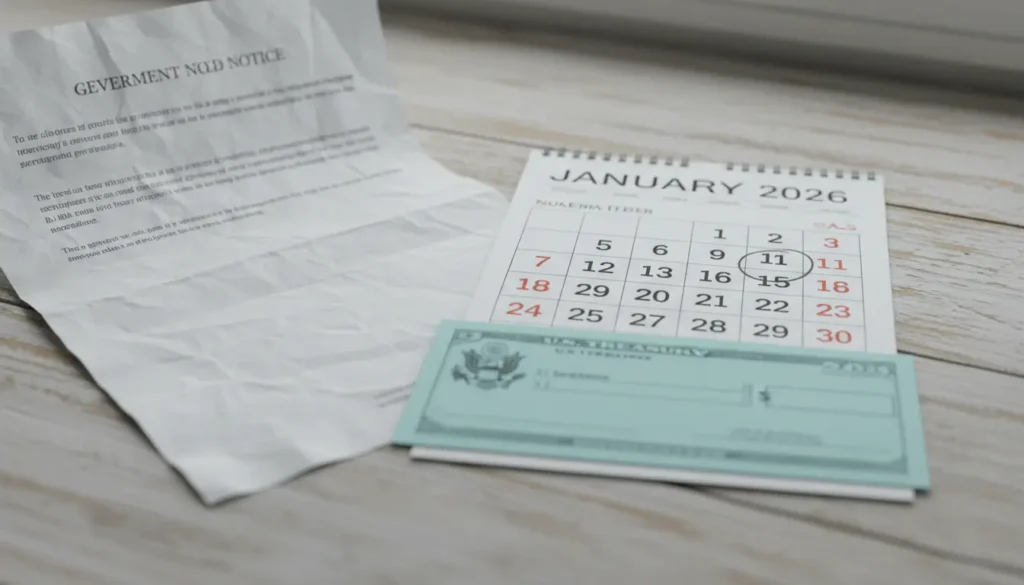

How the $2000 IRS deposit January 2026 will be paid

The IRS typically delivers payments using one of three methods. Expect the same choices for this deposit.

- Direct deposit to the bank account on file with the IRS.

- Mailed paper check to the last known address.

- Prepaid debit card or Treasury-issued instrument in some cases.

Direct deposit is the fastest option. If your bank information is missing or outdated, the IRS will mail a check, which takes longer.

Payment timeline for the $2000 IRS deposit January 2026

The IRS generally follows a multi-week schedule for large deposits. Here is a practical timeline you can expect for January 2026:

- Early January: IRS finalizes payment files and begins processing direct deposits.

- Mid to late January: Most direct deposits arrive first, often over several business days.

- Late January to February: Mailed checks and cards are dispatched and may take additional weeks to arrive.

Timing can vary by bank, weekends, and holidays. If your return was recently filed or adjusted, your payment may be delayed while the IRS reconciles records.

What to do if you don’t receive the $2000 IRS deposit January 2026

Follow these steps if you expect a payment but do not receive it within the expected window.

- Confirm eligibility by checking your filed tax returns and dependents status.

- Verify the IRS has your current mailing address and bank account on file.

- Check your IRS online account for payment status updates and notices.

- Contact the IRS only if the payment is missing after the published timeline; be ready with personal ID and tax information.

Do not fall for scams. The IRS will not call to demand payment or ask for unusual personal information related to deposits.

Reasons payments may be delayed or reduced

Common causes of delay or partial payment include:

- Incorrect or missing SSN on your return.

- Outdated bank account or address information.

- Income above phaseout thresholds causing a reduced amount.

- Ongoing audits, identity verification, or unpaid tax debts that can offset payments.

The IRS often uses the latest tax return on file to determine payment eligibility and deposit method. If you updated your address or bank info after filing, the IRS may still use the earlier data.

How to update information before the payment

To improve the chances of a smooth payment, update your information as soon as possible.

- File your 2025 tax return timely with correct AGI and SSN details.

- Use the IRS online account to update address and direct deposit information if allowed.

- If you moved, submit Form 8822 for address changes where applicable.

Case study: Real-world example

Maria, a single filer, expected the $2000 deposit. Her 2024 return listed a bank account that was closed in 2025. The IRS attempted direct deposit in early January 2026, but the bank returned it.

Result: The IRS reissued a paper check by late January. Maria received the check two weeks later and updated her bank information for future payments.

Lesson: Keep bank and address details current to avoid reissued checks and delays.

Key takeaways about the $2000 IRS deposit January 2026

- Eligibility rests on citizenship/residency, SSN status, and AGI thresholds.

- Direct deposit is fastest; checks take longer to arrive.

- Expect payments to roll out across January into February 2026.

- Update tax records and contact the IRS only after the published timeline if you still do not receive payment.

If you need immediate confirmation, use the IRS online tools or call the IRS helpline. Keep documentation of recent tax filings and any IRS notices handy when you check your status.